The Future of Accounting Careers: Job Prospects & Skills Needed in 2025

As industries continue to evolve with automation, artificial intelligence, and global financial changes, the accounting profession remains a cornerstone of business success. In 2025, the demand for skilled accountants will be stronger than ever, with new career opportunities emerging across sectors. Professionals who stay ahead of industry trends and acquire specialized skills will have a competitive edge in securing high-paying jobs.

The Future of Accounting Careers: Job Prospects & Skills Needed in 2025, Accounting Certification Course in Delhi, 110088 – by SLA Consultants India

Job Prospects in Accounting for 2025

1. Financial Analysts & Management Accountants

Businesses rely on financial analysts and management accountants to assess financial performance, create budgets, and provide strategic recommendations for growth. These professionals play a crucial role in decision-making and business planning.

2. Tax Consultants & GST Specialists

Tax laws continue to evolve, making taxation a critical area for businesses. Skilled professionals specializing in GST, corporate taxation, and international tax compliance will be in high demand.

3. Auditors & Risk Analysts

Companies must comply with financial regulations and internal controls to prevent fraud. Internal and external auditors, along with risk analysts, help ensure transparency, financial accuracy, and compliance.

4. Forensic Accountants & Fraud Examiners

With increasing financial crimes and cyber fraud, forensic accountants are needed to investigate fraud, conduct financial analysis for legal cases, and protect businesses from financial misconduct.

5. Cloud-Based & AI-Driven Accounting Professionals

The rise of cloud accounting software, AI-driven financial analysis, and automation tools means accountants with expertise in Tally, QuickBooks, SAP FICO, and Advanced Excel will have a competitive edge.

Skills Needed for a Successful Accounting Career in 2025

To thrive in the evolving accounting landscape, professionals must acquire the following skills:

- Financial Accounting & Reporting – Strong understanding of financial statements, balance sheets, and profit & loss accounts.

- Taxation & Compliance – Expertise in GST, income tax, and corporate tax laws.

- Accounting Software Proficiency – Hands-on experience with Tally ERP, QuickBooks, SAP FICO, and cloud-based accounting solutions.

- Advanced Excel & MIS Reporting – Ability to analyze financial data using Excel for decision-making and reporting.

- Auditing & Risk Management – Skills in internal auditing, forensic accounting, and fraud detection.

- Digital & AI Accounting Tools – Familiarity with AI-powered accounting solutions for automation and data analytics.

How an Accounting Certification Course Can Help

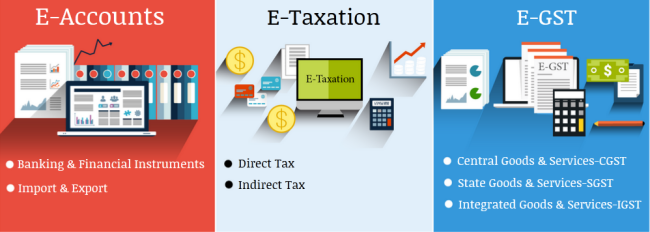

To gain these skills, enrolling in a professional accounting course is essential. SLA Consultants India offers a comprehensive Accounting Certification Course in Delhi, 110088, covering:

The Future of Accounting Careers: Job Prospects & Skills Needed in 2025, Accounting Certification Course in Delhi, 110088 – by SLA Consultants India

- Financial Accounting & Reporting

- Taxation (GST & Income Tax)

- Tally ERP & SAP FICO

- Advanced Excel & MIS Reporting

- Auditing & Compliance

With industry-focused training, practical case studies, and expert mentorship, this course prepares professionals for the future of accounting careers.

Conclusion

Accounting will continue to be a highly rewarding career in 2025, with growing opportunities in financial analysis, taxation, auditing, and digital accounting. By acquiring specialized skills and enrolling in an Accounting Certification Course in Delhi, 110088, professionals can secure stable, high-paying roles in top organizations.

SLA Consultants The Future of Accounting Careers: Job Prospects & Skills Needed in 2025, Accounting Certification Course in Delhi, 110088 – by SLA Consultants India details with New Year Offer 2025 are available at the link below:

Certified Taxation, Accounting, Finance CTAF Course

Module 1 – Advanced Goods & Services Tax Practitioner Course – By CA– (Indirect Tax)

Module 2 – Part A – Advanced Income Tax Practitioner Certification

Module 2 – Part B – Advanced TDS Practical Course

Module 3 – Part A – Finalization of Balance sheet/Preparation of Financial Statement & Banking-by CA

Module 3 – Part B – Banking & Finance

Module 4 – Customs / Import & Export Procedures – By Chartered Accountant

Module 5 – Part A – Advanced Tally Prime & ERP 9

Module 5 – Part B – Tally Prime & ERP 9 With GST Compliance

Module 6 – Financial Reporting – Advanced Excel & MIS For Accounts & Finance – By Data Analyst Trainer

Module 7 – Advanced SAP FICO Certification

Contact Us:

SLA Consultants India

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No. 52,

Laxmi Nagar, New Delhi,110092

Call +91- 8700575874

E-Mail: hr@slaconsultantsindia.com

Website: https://www.slaconsultantsindia.com/